Through participation in the IPO of SF REIT, the first logistics-related REIT listed in Hong Kong, Skymont gained exposure to a modern logistics property portfolio operated by SF (and with around 80% of the space tenanted by SF’s affiliates), a leading force of change in promoting a sustainable ecosystem for the China logistics industry.

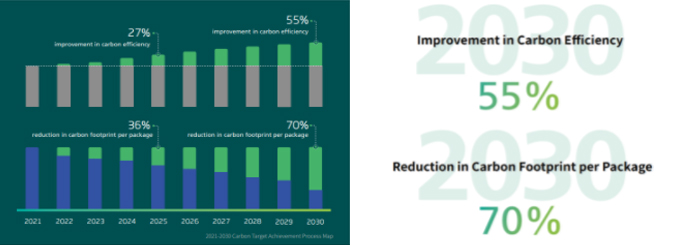

SF Holding — 2030 Carbon Reduction Target and Pathway

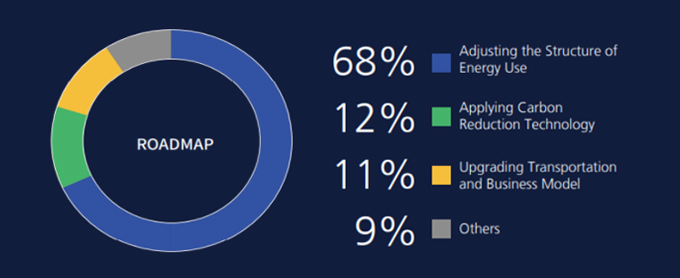

In its 2021 Carbon Target Whitepaper, SF Holding envisions to achieve its ambitious 2030 “55% / 70%” carbon reduction and green transformation targets via renewable energy adoption, technological innovation and green supply chain cooperation over 2021-2030:

SF REIT Portfolio — The Sustainability Perspective

SF REIT comprises a modern logistics property portfolio strategically located within regional key logistics hubs and near major transportation infrastructure in the Greater China region. The current portfolio consists of +300,000 sqm of high-spec warehouse facilities equipped with automatic sorting and supply chain support facilities, efficiently supporting the local trade and economy.

- Sample Asset: Asia Logistics Hub – SF Centre | Tsing Yi, Hong Kong

- Gold rated LEED-certified modern industrial building recognized for its sustainability design features:

- 5-storey logistics property with vehicular ramp access to all warehouse floors

- Large and regular floor plates, high ceilings and wide column spacing, allowing for optimal spacing utilization

- Advanced ventilation, fire fighting and sprinkling systems

- Energy-efficient building materials

- Convenient access to arterial roads and major business districts in Hong Kong, and major transportation infrastructure in the Greater Bay Area